Is Google late to the Soundbox party? Or maybe not!

Image Credits: NewsBytes

Tech giant Google is reportedly piloting a white labeled sound box ‘Soundpod by Google Pay’ in the Indian market, which is designed by Tone Tag. Both Walmart-owned PhonePe and BharatPe launched their soundboxes last year.

Soundbox boosts security and trust by announcing payments received in the account, preventing fraud. First to this market Paytm claims to have distributed more than 5.8 million devices to date, with 1 million soundboxes each in its last two quarters only. Its soundbox devices processed 5 billion transactions in FY 2022 which accounts for the company’s 38% net payment revenue (according to CLSA report). Last November, PhonePe said it deployed 1 million payment speakers across the country.

Fintech companies charge low monthly rental from merchants, but incur a maintenance cost of Rs 25 per unit for the SIM card. In addition, there will be some back-end costs apart from the capex cost of physical devices. Paytm charges an average rental of Rs 75 per month, while PhonePe charges Rs 49 per month. Sometimes they also give the device for free to many sellers to get them onboard. All in all it is a loss making proposition.

Why is Google entering this space?

Fintech players have realized that the ultimate goal is B2B lending for profits. However, traditional underwriting methods make it expensive to enter the small ticket unsecured MSME/MSE loans market.

Underwriting on UPI transaction data/device data can provide cheaper credit, i.e., cash flow based lending in deeper parts of India. It also solves collections with EDI(equated daily installments) via virtual account setups with merchant’s auto-debit consents for repayment adjustments.

If Google provides these ‘SoundPods’ (as they call it) for zero upfront fees and minimum rental, it can scale up merchants' onboarding really fast. Soundbox has already helped Paytm scale up its merchant lending. Paytm's disbursals of merchant loans grew 178% YoY to Rs 565 crore in Q1'22, with an average loan size of Rs 1.3-1.5 lakh and tenure of 12-14 months. However, being a listed company Paytm must show early profits and a recent report from Macquarie estimates a hit of Rs 400 crore in revenues and Rs 500 crore on EBITDA if rentals on all sound devices for merchants were made zero

On the other hand PhonePe and Google Pay can continue cash burn to distribute soundbox to new merchants (even for free) to be able to ultimately lend them. This could be a clash of the titans with both PhonePe and Google Pay willing to be the loss leaders as long as they can achieve flow based lending.

Google’s model of how it will differentiate the game to retain merchants is yet to be revealed.

Payment Aggregator: A New Business Opportunity for Payment Players?

Image Credits: Medium.com

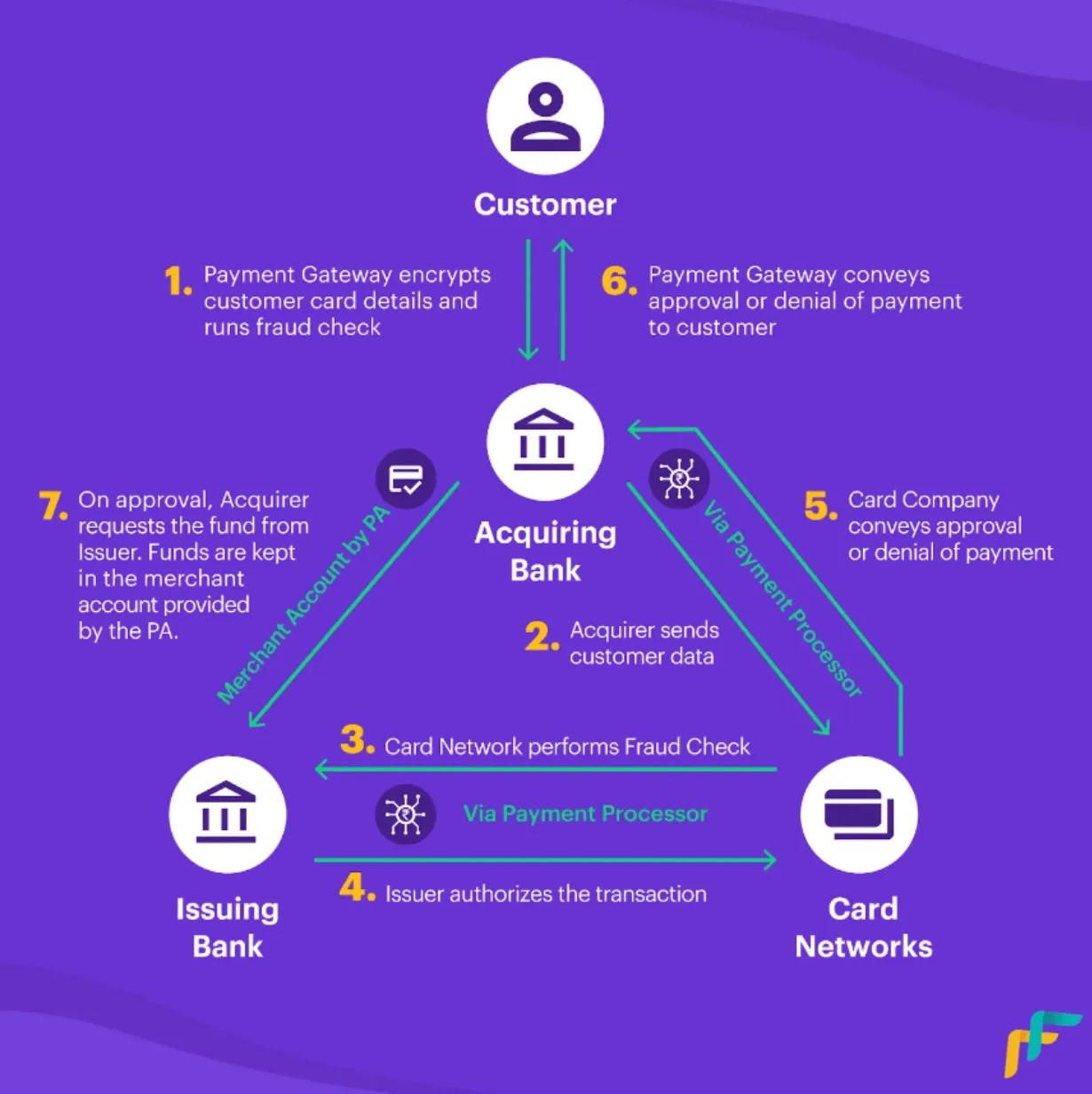

Payment aggregator provides services by integrating different payment options like cheques, cash, online payment options, and offline touch points (in-store, in-field, and remote SMS-based transactions). It allows merchants to accept any type of payment without having separate accounts with banks.

More than 185 fintech businesses and startups submitted their applications for a license to operate as a payment aggregator to the RBI. Currently, there are 80 payment aggregators in India including third-party payment aggregators and bank payment aggregators. Apart form India's public and private sector banks, third party players like BharatPe, Infibeam, Cashfree, Paysharp, Hitachi payment services, Enkash, Worldline ePayments, etc. have the license. Meanwhile, RBI has asked PayU and Paytm to reapply for a payment aggregator license.

How do payment aggregators work in India?

Image Credits: Cashfree

Payment aggregators operate on wafer thin margins. Income and profit depend on how they negotiate costs and deals with merchants and banks. Payment aggregators earn the revenue from merchant discount rate (MDR) and the profit depends on pricing. This is the beauty of volume game, a small margin translates in huge profit over the period but with a small mis-pricing merchant will end up losing huge money.

There are several ways for payment aggregators to make a profit:

- Keep the MDR higher than the cost paid to different payment instruments/modes

- Intelligent routing mechanism to direct the volume towards less charging payment modes

- Charge the banks some subvention for a volume commitment

Why are many fintech players trying for a payment aggregator license?

Many payment players are trying for a payment aggregator license in India because it allows them to provide a range of payment services to customers through a single point of integration. This includes services such as online payments, mobile payments, UPI (Unified Payments Interface) and BNPL transactions. Obtaining a payment aggregator license will also allow payment players to access the country's large and growing e-commerce market and to compete with established players in the payments space.

Additionally, embedded finance is on the rise and becoming more popular. Many fintech companies are offering it on digital marketplaces. Many payment players are looking to get a payment aggregator license to take advantage of embedded finance.

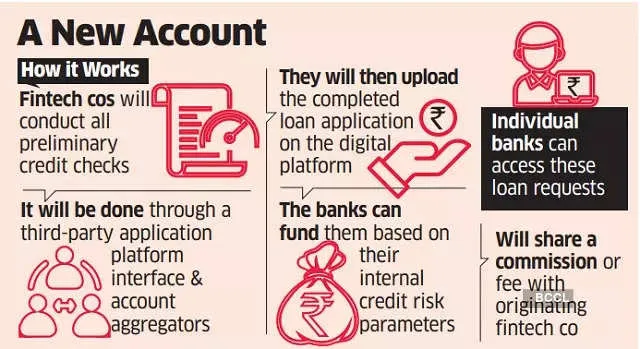

Joint Digital Platform: PSBs Plan to Connect with Fintech Companies

Public sector banks (PSBs) are planning to set up a digital platform based on a unified cloud to connect with fintech companies for online lending on a revenue sharing basis. It will be governed by a new body called PSB alliance Ltd which is a company setup by all public sector banks, jointly offering important customer-oriented services envisaged by GOI.

Fintech companies will handle loan application processing, including data collection and initial KYC checks, using API and account aggregator. The finished application will be uploaded to the digital platform. Banks will access the application and provide credit based on their own evaluation criteria and share a commission or fee with the originating fintech company.

How OCEN is different from PSBs' joint digital platform?

An open credit enablement network (OCEN) is a standardised frameworks of APIs that allows for the sharing and exchange of credit information between financial institutions and other fintech players in order to make credit decisions more accurate and efficient. It is a form of digital public goods announced at the Global Fintech Festival 2020 by Government of India.

On the other hand, joint digital platforms offered by PSBs is a platforms for disbursement and reporting. The idea is that the fintech firms will onboard large corporate and their suppliers or dealers for supply chain finance (SCF) business. The platform will provide credit-related services such as loan applications assessment, disbursement and commission sharing.

Why is a unified cloud based digital platform required?

The digital platform will allow banks and fintech companies to connect with each other via a single integration reducing development costs. The platform will act as a central knowledge base for both parties and data sharing will become easy. This will lead to reduction in fraud cases as parties will be aware of defaults done by customers or any KYC issue related to customers.

What is there for PSBs and fintech companies?

- State-run banks can leverage the resources of multiple fintech firms, reducing the cost of sourcing loans and investing in expensive platforms or technologies

- PSBs and fintech companies can save cost of integration and provide a uniform customer journey

- Fintech companies can gain easy access to capital and increase revenues

- It is yet to be seen how PSB Alliance Ltd's initiative will materialize in India's highly regulated digital lending landscape

- A significant concern is the security and sharing of data between regulated and unregulated entities

- The revenue sharing model for stakeholders such as PSBs, fintech platforms, payment gateways, and payment aggregators

- Cashfree lays of 100 employees to reduce cost. Read more

- KreditBee raises $120 million funding in new tranche. Read more

- Investors forked out Rs 8,000 cr to shift base from Singapore to India, says PhonePe CEO Sameer Nigam. Read more

- Visa and Mastercard may be allowed a share of India's online payments. Read more

- Indian fintech micro-lender KreditBee tops-up Series D by $120m. Read more

- RBI asks PayU India to reapply for a payment aggregator license. Read more

- Advantage Paytm says analysts as Alibaba cuts stake in Vijay Shekhar Sharma-led fintech. Read more

- PM Modi holds a meeting with economists at NITI Aayog; applauds the success of India digital story & rapid adoption of fintech across the country. Read more

- Yubi Becomes India’s first fintech company to achieve the SOC 2 type II attestation for data security and privacy. Read more

That’s it, folks

Cheers,

Yatharth